There appears to a be a considerable consensus on various web sites that indeed they are.

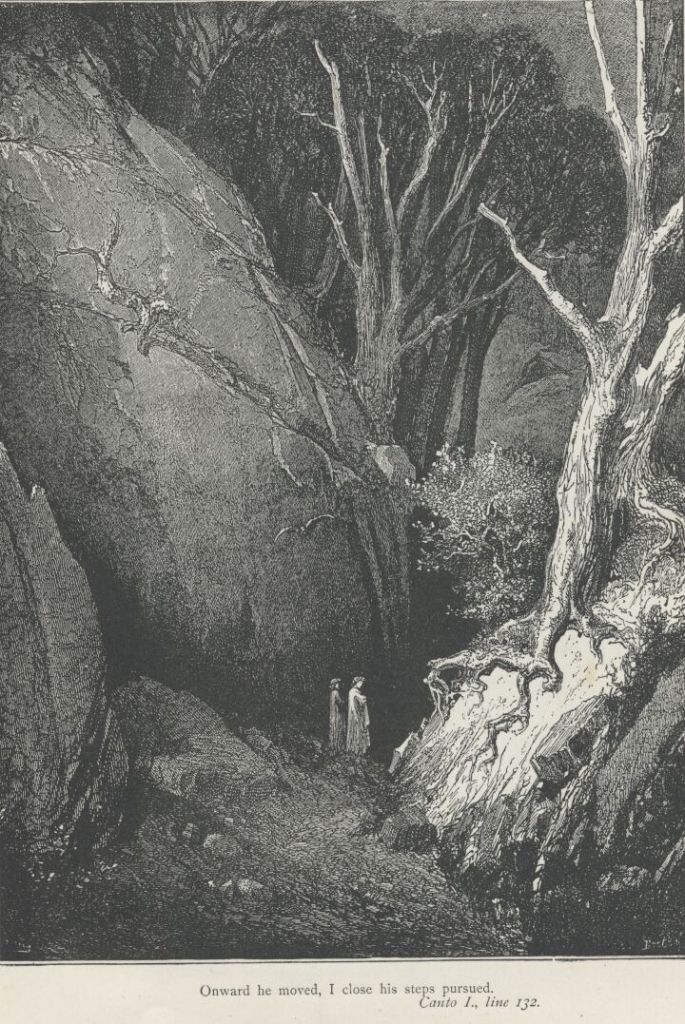

(That does look like corporate leadership, a daunting path, indeed!)

Let’s begin with the Guardian in an article by Michael Sainato talks about his pay.

https://www.theguardian.com/us-news/2025/jul/24/trump-bill-ceo-pay-starbucks

Starbucks’ CEO, Brian Niccol, made 6,666 times more than his average worker last year, according to a report on the growing gap between top executives and their workers.

The inequality gap between CEOs’ pay and that of their median workers rose in 2024 to 285 to 1 from 268 to 1 in 2023, according to a report released this week by the largest federation of labor unions in the US, the AFL-CIO.

I will freely disclose that I find the CEO in question, Brian Niccol, reptilian and repulsive, and that is beside the fact that he is paid way too much.

But there’s more. Here’s an article from 2023 By Nik Popli. He writes about an investor advocacy group that calls out CEO’s who get generous pay packages while their companies suffer losses particularly in shareholder returns. I recommend you read the entire article.

https://time.com/6256076/most-overpaid-ceos-2022/

The typical CEO of a company listed on the S&P 500—a stock market index with 500 large publicly traded corporations—earned $18.8 million last year. That’s up roughly 21% from 2021, even though the S&P 500 index was down 20%. Company boards gave particularly big grants of stock to reward those in charge of navigating their companies through high inflation, continued supply chain problems, and rising wages—as well as meeting performance metrics.

But an investor advocacy group says some of the nation’s most well-known companies overpaid their chief executives. A new report from As You Sow listed 100 “overpaid” CEOs who received high compensation in 2022 despite mixed shareholder returns for their companies.

At the top of the list: Warner Bros. Discovery’s David Zaslav, who received $246 million in 2022 even though the company’s stock fell 60% in the same year and roughly 40% of shares voted against his pay package. The second most overpaid CEO was Estée Lauder’s Fabrizio Freda, who earned $66 million in 2022 while the company’s stock fell 33%. Penn National Gaming’s Jay Snowden, who was paid $65.9 million, comes in at no. 3 on the list; his company’s stock fell 42.7%.

And for the year before, we have the magazine Fortune in an article by Chris Morris, Maria Aspan entitled rather directly These are the 10 most overpaid CEOs in the 2022 Fortune 500. Once again, I liked the article and recommend you read it in full.

https://finance.yahoo.com/news/10-most-overpaid-ceos-2022-175248791.html

Overall hourly U.S. wages fell 2.4% on average last year (after adjusting for inflation), but the median total compensation of CEOs Fortune studied as part of this year’s Fortune 500 ranking jumped 30% from a year earlier to $15.9 million.

That made us curious. Did those CEOs deserve the compensation packages they received? Fortune’s Maria Aspan and Scott DeCarlo analyzed the compensation and stock performance of the 280 Fortune 500 CEOs who have held their jobs for at least three years, ranking them on pay vs. performance.

Apparently factual analysis based on the statistics of market performance does not paint an appealing picture of CEO pay. I am not surprised. The media celebrates these figures as fearless leaders and innovative entrepreneurs with little actual examination of the facts. And the way corporate power is structured, an obedient board of directors is just a matter of time for an aggressive CEO.

The Progressive Shopper posts the “Overpaid CEO Score Card.”

The list identifies the 100 Most Overpaid CEOs from the S&P 500 index, highlighting those CEOs deemed excessively compensated based on their performance. It specifically focuses on CEOs who were addressed at annual meetings held between July 1, 2022, and June 30, 2023. This year’s findings also incorporate insights from annual voting patterns and regression analysis conducted by HIP Investor.

Mentioned previously was the Shareholder Advocacy Group, “As You Sow.” This is a ten year study they published about CEO compensation entitled 10 Years of Study Shows Overpaid CEOs Underperform.

Listed below the link are its most damning conclusions.

https://www.asyousow.org/press-releases/2023/11/15-ten-year-study-overpaid-ceo-underperform

Key findings:

- Companies with the most overpaid CEOs have had lower returns to shareholders than the average S&P 500 company. The typical S&P 500 firm made 8.5% per year annualized from February 2015 to September 2023, the 100 Most Overpaid CEOs’ annual returns lagged at 7.9%, the worst 25 dragged at 6.0%, and the ten worst were behind at 6.5% per year. As a group, over a decade, overpaid CEOs underperformed.

- Total pay for the most overpaid CEOs continues to grow. When As You Sow compiled its first overpaid CEO list ten years ago, the average pay of the 10 Most Overpaid was $56 million. This year, the average of the top ten was $88 million, an increase over that time period of 59%.

There were more articles and many opinion pieces. All these sources saying that CEO’s are over paid — and, yet, they continue to be overpaid!

But it seems likely that AI and an increasingly darkening economic horizon under our current regime’s bizarre decision making may very well diminish these payouts.

We can hope!

James Alan Pilant

You must be logged in to post a comment.